WHAT IS PRIVATE LENDING?

A private money loan is a loan that is given to a real estate investor, secured by real estate. Private money investors are given a first or second mortgage that secures their legal interest in the property and secures their investment. When we have isolated a home that is well under market value, we give our private lenders an opportunity to fund the purchase and rehab of the home. Through that process, the lender can yield extremely high interest rates – 4 or 5 times the rates you can get on bank CD’s and other traditional investment plans.

Essentially, private money lending is your opportunity to become the bank, reaping the profits just like a bank would. It’s a great way to generate cash flow and produce a predictable income stream – while at the same time, provide excellent security and safety for your principle investment. You can do what the banks have been doing for years…make a profitable return on investments backed by real estate. There is no other investment vehicle like it.

Through private money lending, you have the Opportunity to become the bank

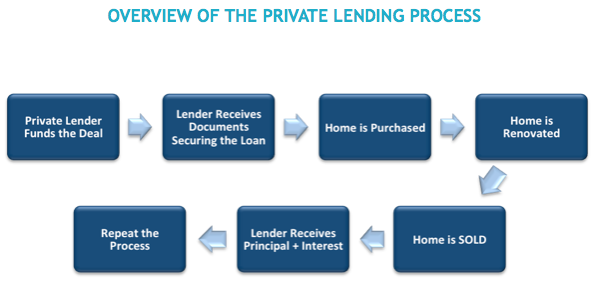

HOW THE PROCESS WORKS

The process is simple. We find an extremely undervalued property we want to purchase – and once you give us the green light, we borrow the funds from you to purchase and renovate the property. At closing, you receive a mortgage on the home along with other important documents. Next stage is the property renovation. Once the renovations are complete (typically 3-6 months depending on the size of the project), we’ll list and sell the property. When it’s time for closing, you’ll receive your principle plus 10% interest payment. It’s just that simple! The goal is to keep turning that money for you and keep you making substantial profits so you keep coming back to us – building a long term mutually beneficial relationship.

INVESTMENT DEAL SCENARIO

Here’s what the numbers would look like on a typical renovation project, with a 6 month hold (including rehab & re-sell time) with a private lender return of 10%.

Purchase Price: $95,000

Repair Cost: $68,000

Total Invested: (6 Month Hold) $163,000

Sales Price: $250,000

Lender Potential Return on Investment = $8,150

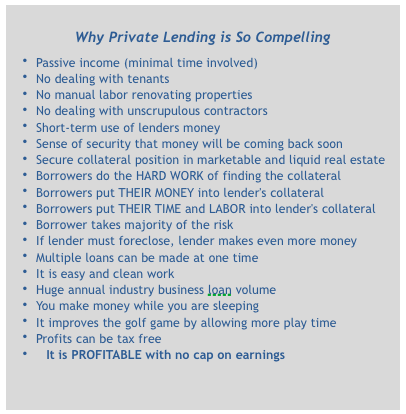

HOW YOU BENEFIT FROM PRIVATE LENDING

You, as the private money lender can benefit greatly from investing your capital. A real estate mortgage/ deed of trust provides you with security instruments you would not get with other investments. You also have added layers of protection because of how we buy, and because you have recourse available to you in case we were to default on the loan.

We currently pay 4-5 times what a typical bank CD is paying. Our rates will fluctuate very little all depending on the purchase price and rehab involved. The lower the price we pay for a home, we can pay a little higher rate to make sure our lenders make it worth their time. Private lending means you can relax while the money is in a truly safe place, working for you.

It’s a win/win opportunity for both the lender and borrower

Our equity is built in the purchase of the home, where we are buying 30-40% below a retail buyer – that creates instant equity at purchase.

Also, in a typical transaction, we cut out the middleman cost, such as:

commissions, mortgage broker fees, loan fees; and our attorney costs are also lower because there is less work for them to review.

Because of our buying strategy, we are able to offer our buyers a fully renovated home at or below everything else in the neighborhood. We walk away from hundreds of “close” deals that do not meet our specific buying criteria, and simply won’t buy unless it makes sense for everyone involved.

HOW PRIVATE MONEY HELPS OUR COMPANY

Private money lenders bring speed and efficiency to our transactions, and our leverage is far greater when we purchase using private cash funds . Many of the homes we are purchasing are in need of quick sale within 10-14 days. A traditional bank requires 30-45 days to close a loan. Many traditional home sales fall out of contract because of financing issues. Using quick cash as leverage allows us to negotiate a much lower purchase price and reduce our risk.

Being able to offer a fast closing with private funds motivates sellers to take our offer over the competition, and entices them to take a much lower price than they would from a conventional buyer. Also, lending guidelines are also continually changing and are requiring applications, approvals, junk fees and strict investor guidelines. They also limit the number of investment properties that can be purchased by one company.

On a new home purchase requiring renovations, private lender funds will be allocated to the purchase price, renovations, carrying costs, cost to resell and a small buffer for unexpected expenses.

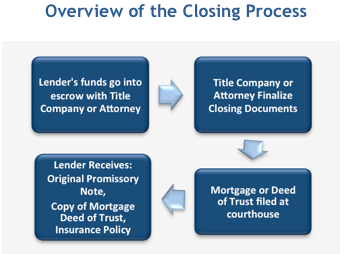

WE PROTECT OUR LENDERS

Mortgages offer the banks solid, long-term, fixed returns. You can put yourself in the position of the bank by directing your investment capital, including retirement funds to well-secured real estate mortgages. Mortgages have ultimate safety because if default occurs, the bank can recover its investment as the first lien holder on the property.

Each property we acquire is put through a rigorous evaluation process in order to assess the profitability before the property is ever purchased. “lntegrity” is an essential part of our business, and we only make sound investment decisions. Also, for your protection, you are also provided these documents to secure your investment capital:

Promissory Note: This is your collateral for your investment capital

Deed of Trust/Mortgage: This is the document that is recorded with the county clerk and recorder to publicly secure your investment against the real property that we are providing as collateral

Hazard Insurance Policy: This is where you as the private lender would be listed as the “Mortgagee” for your protection in case of fire or natural disaster, etc.

We do pay for a title search as well as a title policy on the home just as we would in a typical transaction. For a rental investment with a long-term note, we always keep a valid hazard insurance policy on the property to protect against causalities. You’ll be named as a mortgagee and notified if the insurance was not kept current. In the event of any damage to the property, insurance distributions would be used to rebuild or repair the property, or used to repay you.

Common Ways Private Lenders Fund Deals

Cash

Cash held in most types of bank accounts can be accessed quickly and can fund your deals in minutes, instead of hours or days. Fees are generally minim al for wire transfers and cashier’s checks.

Home Equity Line of Credit

A home equity line of credit is a very powerful source of funding that many people have and don’t even think of. Unleveraged equity is dead money and it’s not making any interest. You can easily tap into that money. It’s a way to make sure you’re in first position when we’re ready to pull the trigger and buy a property.

Personal & Business Lines of Credit

Personal loans and “signature lines of credit” can be obtained from most banks or credit unions by anyone with good credit and a stable income.

Retirement Accounts

More and more private money lenders are using their IRA funds to invest in real estate. A self-directed IRA is essentially the same as a traditional IRA, but allows you to purchase a broader range of investments, including real estate.

Liquidated Securities & Investments

Investments are a way to put your savings to work earning more money. However, if your stocks and investments have not performed as you had expected, it might be time to consider other investments. As you know, stocks can be liquidated as and when you wish. Sometimes you need to liquidate your investments because you need the money for something you want to purchase such as real estate.

Investing With a Self-Directed IRA Account

Most people think that an IRA can only be used to purchase investments, like stocks and mutual funds. But that’s not true! You can get private mortgage loans using the funds which are already in your IRA’S and other retirement plans.

As it pertains to lending for real estate investments, enter the Self-Directed IRA. The IRS has set forth guidelines on what you can and cannot invest in with your IRA. Many people are surprised at the scope of options available. From tax liens, gold, real estate investments and real estate notes, IRA’s are much more powerful than most people ever realized. If you add to that power of a Roth IRA which allows you to enjoy your earnings tax-free or deferred, and you’ve got a fast road to an easy retirement!

However, in order for you to use retirement accounts for loans, they must first be administered by a third party custodian. After selecting your custodian, you simply send a transfer form to them and they’ll do all the work for you, once you’ve done that you are ready to make private mortgage loans. We would be happy to recommend a local custodian we’ve worked with in the past who can assist you with setting up your account.